Writing and art by Alex Stone

Miracle of Wörgl

In these days of miracle and wonder (not), when our collective orbit has been reduced to the home office, larger questions abound.

Like, what is the future of money? Can it still work? Or, can it work in a different way? Who gets to give you money, when you’re sitting in lockdown? Are the rules of capitalism set in stone? What if money had a use-by date? What if keeping money had no advantages?

Allow me to introduce the Wörgl Miracle – or Experiment, depending on your point of view.

Wörgl (groovy name) was a wee town in Austria that tackled the Great Depression in a novel way. It broke all the rules of standard capitalist economic theory. Wörgl printed money. They gave it to the townsfolk, for free.

Whaat? You may say, but it worked. Truly.

Here’s how it happened. Like small towns everywhere in the Great Depression, Wörgl had people sitting around, out of work. And shops with no customers. The usual story.

Wörgl had a population of 4,216. Being a railway junction, the railway employed 310 people in 1930, but by 1933 the number had plummeted to 190, following the transition to electric loco’s. The cement plant in nearby Kitzbühel employed 50 workers in 1930, but by 1933 only 2. The Zipf brewery sacked between 10–14 workers from the previous 33–37. A cellulose factory had once employed 400 workers. In 1933, just four men were there, idly guarding idle machines. Farmers, a third of the work force, could hardly sell their products at depressed prices.

But the town’s mayor, Michael Unterguggenberger (off-the scale groovy name!) suggested something radical. Let’s print our own money.

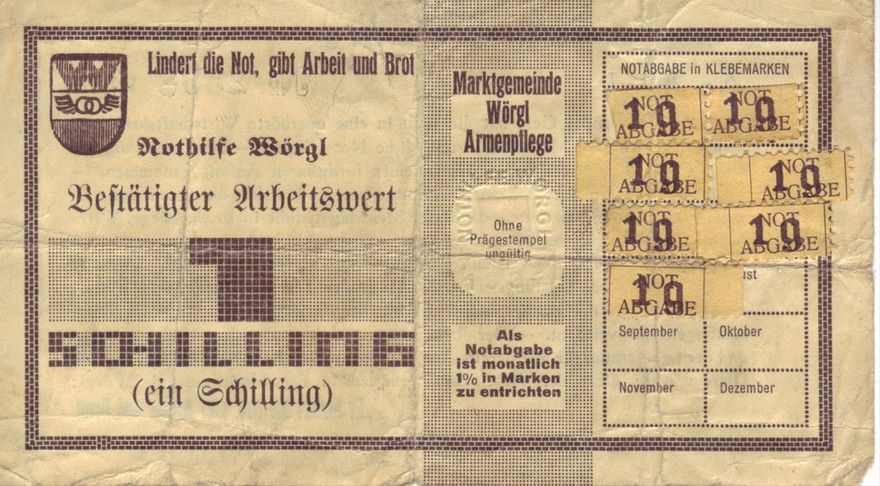

The experiment began on the 31 July 1932, with the issuing of ‘Certified Compensation Bills’, Wörgl’s own currency. It was cheerfully named Freigeld – or as Stamp Scrip, if you will.

Result: a boom in local government projects, and a corresponding increase in employment and economic activity not just in the government sector, but throughout the town.

People had to spend their free money. And spend it they did, on contractors to do building, on food and furniture and stuff in the local shops, to pay farm workers to plough the land and bring in the crops. People paid their taxes.

Wörgl money worked differently. It had a use-by date. So it didn’t pay to accumulate it. You had to spend your allocation by the end of the year – or it would decline in value by 10 per cent. In dry economic terminology, this is called currency demurrage.

“Whatever,” said the people of Wörgl. And carried on spending up large.

Irony, bigly these days, is that Wörgl banknotes are now seriously collectible items – worth a fortune, especially those with the devaluation stamps attached.

Anyway, Wörgl money had the effect of jump-starting the local economy. Things started humming. The money had to be used, you see. Where’s the problem in that?

Now, money as we know it, was invented to accumulate in value. For those of a religious bent, that is reflected in usury – the practice of lending money at unreasonably high rates of interest, so the money you give out comes back as more. That’s what caused Jesus to lose his cool at the Temple on the Mount. And in the next Abrahamic religion that came along, Islam, the charging of interest came to be seen as sinful.

People further than Wörgl’s town limits sat up and took notice; among them such luminaries as French Premier Edouard Daladier and the economist Irving Fisher. The “miracle” gained notoriety, and other towns wanted to copy the experiment hoping for similar success. Nearby villages even arranged to accept each other’s scrip.

In June 1933 Mayor Unterguggenberger was the star at a presentation in Vienna for 170 Mayors—they were intrigued on hearing reports from Wörgl. Among the attendees, some opined that it would be a go to introduce "magic money" in their communities too.

But the rich and powerful didn’t like it. Wörgl did not fit their script. It was supposed to be their schtick to hold great sums of money (and therefore power), and for this money to accumulate. The poor folk, like those in Wörgl, were supposed to borrow money at the rich folks at exorbitant interest rates.

So, under pressure from the wealthy elite, the Austrian government capitulated. The Wörgl miracle was murdered by the Austrian National Bank on 1 September, 1933.

Looking back on the whole of Wörgl thing, contemporary economists say the Miracle couldn’t last. They use dry and dreary and self-serving arguments like, “any threat to centralized control is a threat to the money power”(Yeha! Right on!); or “Wörgl could not legislate or enforce monopoly legal tender, so the demand for the scrip is partially attributable to the need to pay taxes” (so what?); or “In a matter of days the national scrip held as backing in the bank would have been exhausted” (but who needs banks anyway, when you get free money?) or “Wörgl was not a miracle, but an example of Keynesian spending given incentive by Gresham’s Law” (blah, blah…).

But then you could say, the ‘experiment’ of capitalism as we know it – endless growth and resource extraction, the rich getting richer and the poor getting poorer – can’t last anyway.

And now we have a new window on this capitalism deceit. How come, we say, the economies of the world collapse when people buy only what they need?

Come back Wörgl. We need you now.